20-F: Annual and transition report of foreign private issuers pursuant to Section 13 or 15(d)

Published on November 21, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No.

(Exact name of registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

Telephone: +44 203 91 70155

(Address of principal executive office)

Telephone:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| ● |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

Non-accelerated filer |

Emerging growth company |

|

☐ |

☑ |

☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP |

Other |

|

☐ |

Accounting Standards Board ☑ |

☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

No ☑

Page |

||

PART I |

||

8 |

||

8 |

||

8 |

||

8 |

||

8 |

||

8 |

||

8 |

||

22 |

||

22 |

||

22 |

||

31 |

||

31 |

||

31 |

||

31 |

||

31 |

||

41 |

||

43 |

||

43 |

||

44 |

||

44 |

||

46 |

||

47 |

||

50 |

||

50 |

||

Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation |

50 |

|

50 |

||

50 |

||

52 |

||

52 |

||

52 |

||

52 |

||

53 |

||

53 |

||

53 |

||

53 |

||

53 |

||

53 |

||

54 |

||

54 |

||

54 |

||

54 |

||

54 |

||

64 |

||

64 |

||

64 |

||

71 |

||

71 |

||

71 |

||

72 |

||

72 |

||

72 |

||

72 |

||

72 |

||

72 |

||

72 |

PART II |

||

73 |

||

Material Modifications to the Rights of Security Holders and Use of Proceeds |

73 |

|

73 |

||

74 |

||

74 |

||

74 |

||

74 |

||

74 |

||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

74 |

|

74 |

||

74 |

||

75 |

||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

75 |

|

76 |

||

76 |

||

76 |

||

F-1 |

INDUSTRY AND MARKET DATA

In this Annual Report, we present industry data, information and statistics regarding the markets in which the Company competes as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with the Company’s own internal estimates and information obtained from discussions with its customers, taking into account publicly available information about other industry participants and the Company’s management’s judgment where information is not publicly available.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this Annual Report. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.” These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

1

FREQUENTLY USED TERMS

Unless otherwise stated or unless the context otherwise requires, the terms “the Company,” “the registrant,” “our company,” “the company,” “we,” “us,” “our,” “ours,” and “Arqit” refer to Arqit Quantum Inc.

In this Annual Report, unless the context otherwise requires:

“Arqit” or “Company” means Arqit Quantum Inc., a Cayman Islands exempted limited liability company with registered number 374857 and whose registered office is at Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

“Articles” means the memorandum and articles of association of Arqit.

“British pounds sterling” or “£” means the legal currency of the United Kingdom.

“Business Combination” means the transaction completed on September 3, 2021 pursuant to the Business Combination Agreement, in connection with which Centricus Acquisition Corp. merged with and into Arqit Quantum Inc., with Arqit Quantum Inc. as the surviving entity, following which Arqit Quantum Inc. acquired all of the outstanding share capital of Arqit Limited, with Arqit Limited becoming a wholly-owned subsidiary of Arqit Quantum Inc.

“Business Combination Warrants” means Arqit’s 13,038,904 outstanding warrants to purchase its ordinary shares at an exercise price of $11.50 per share which became exercisable on February 8, 2022.

“Cayman Companies Act” means the Companies Act (As Revised) of the Cayman Islands, as may be amended from time to time.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“COVID-19” means the disease known as coronavirus disease or COVID-19, the virus known as severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) and any evolutions or mutations thereof.

“EAR” means the Export Administration Regulations of the U.K. Export Control Act 2002, as amended.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“February 2023 Investor Warrants” means Arqit’s 7,500,000 outstanding warrants to purchase its ordinary shares at an exercise price of $2.00 per share, which became exercisable on February 22, 2023.

“February 2023 Placement Agent Warrants” means Arqit’s 550,000 outstanding warrants to purchase its ordinary shares at an exercise price of $2.50 per share, which became exercisable on February 22, 2023.

“Gartner” means Gartner, Inc.

“IFRS” means International Financial Reporting Standards as adopted by the International Accounting Standards Board.

“IRS” means the U.S. Internal Revenue Service.

“ITAR” means the International Traffic in Arms Regulations of the Bureau of Industry and Security of the U.S. Department of Commerce.

“JOBS Act” means the Jumpstart Our Business Startups Act of 2012, as amended.

“Nasdaq” means the Nasdaq Capital Market.

“NATO” means the North Atlantic Treaty Organization.

“NIST” means the U.S. Department of Commerce’s National Institute of Standards and Technology.

“ordinary shares” means the ordinary shares, with $0.0001 par value per share, of the Company.

“PFIC” means passive foreign investment company within the meaning of Section 1297 of the Code.

2

“PKI” means public key infrastructure.

“QEF election” means a “qualified electing fund” election under Section 1295 of the Code.

“Registration Rights Agreement” means the Registration Rights Agreement dated September 3, 2021 among Arqit, Centricus Heritage LLC, Adam M. Aron, Nicholas Taylor, the shareholders of Arqit Limited prior to the completion of the Business Combination and Heritage Assets SCSP.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the U.S. Securities Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“September 2023 Investor Warrants” means Arqit’s 20,755,677 outstanding warrants to purchase its ordinary shares at an exercise price of $0.78 per share, which became exercisable on September 12, 2023.

“September 2023 Placement Agent Warrants” means Arqit’s 705,128 outstanding warrants to purchase its ordinary shares at an exercise price of $0.975 per share, which became exercisable on September 12, 2023.

“U.S. dollar” or “$” means the legal currency of the United States.

“warrants” means the Business Combination Warrants, the February 2023 Investor Warrants, the February 2023 Placement Agent Warrants, the September 2023 Investor Warrants and the September 2023 Placement Agent Warrants.

3

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

This Annual Report contains our audited consolidated financial statements as of and for the periods ended September 30, 2023, 2022 and 2021 (our “audited consolidated financial statements”). The Company qualifies as a foreign private issuer as defined under Rule 405 under the Securities Act and prepares its financial statements denominated in U.S. dollars in accordance with International Financial Reporting Standards as adopted by the International Accounting Standards Board (“IFRS”).

4

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS AND

RISK FACTOR SUMMARY

This Annual Report contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, the provisions of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Exchange Act of 1934 (the “Exchange Act”). These forward-looking statements are subject to risks and uncertainties and include information about possible or assumed future results of the business, financial condition, results of operations, liquidity, plans and objectives of the Company. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. The statements regarding the following matters are forward-looking by their nature:

| ● | that there will be significant market opportunities for the Company’s products as a result of an expected transformation in the cyber encryption industry over the next decade; |

| ● | that consumers, businesses and governments across all geographies and industries will likely need to replace the existing cyber encryption technology used in almost all electronic interfaces in order to maintain cyber security; |

| ● | that the global addressable market for information security services will be $289 billion by the end of 2027; |

| ● | that new opportunities for growth in demand for the Company’s products are expected in government, defense, telecoms, financial services, Internet of Things and connected car markets; |

| ● | that “public key infrastructure” will be vulnerable to quantum computer attack; and |

| ● | that quantum computers of sufficient scale to break “public key infrastructure” may be available within a few years. |

The preceding list is not intended to be an exhaustive list of all of forward-looking statements in this Annual Report. The forward-looking statements are based on beliefs, assumptions and expectations of the Company of future performance, taking into account the information currently available. These statements are only predictions based upon the current expectations and projections of the Company about future events.

You should not rely upon forward-looking statements as predictions of future events. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, they cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, the Company undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report, to conform these statements to actual results or to changes in expectations.

Important risks, uncertainties, assumptions, and other factors that could cause our actual results or conditions to differ materially from our forward-looking statements include, among others, the items in the following list, which also summarizes some of our most principal risks:

| ● | The Company is an early stage company with a history of losses and will be reliant upon a significant increase in sales and marketing activity in order to become profitable in the future. |

| ● | The Company’s limited operating history makes it difficult to evaluate its business and future prospects and increases the risk of your investment. |

| ● | The market adoption of the Company’s product is not fully proven, is evolving and may develop more slowly than or differently from the Company’s expectations. Its future success depends on the growth and expansion of these markets and its ability to adapt and respond effectively to evolving markets. |

| ● | The Company’s primary distribution channel is through channel partnerships, and therefore the Company is dependent upon maintaining and increasing the number of channel partnerships, and developing annual recurring revenues through those channel partnerships, in order to continue to develop its business. |

| ● | If the Company fails to sell or otherwise monetize its satellite currently under construction, it may be required to recognize further impairment losses, write off capitalized satellite costs or incur breakage fees under certain of its contracts related to satellite construction obligations. |

5

| ● | The Company will require additional capital to fund its operations, and if it is unable to obtain such capital, it will be unable to successfully continue to develop its business and commercialize its products. |

| ● | The Company is reliant upon the lease of data center capacity and access to fiber optic infrastructure from third parties in order to commercialize its product. |

| ● | The complexity of the Company’s products could result in unforeseen delays or expenses from undetected defects, errors or reliability issues in software, which could reduce the market adoption of its new products, damage its reputation with current or prospective customers and expose it to product liability and other claims and adversely affect its operating costs. |

| ● | The Company may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its products or technology. Its efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly. |

| ● | Third-party claims that the Company is infringing intellectual property, whether successful or not, could subject it to costly and time-consuming litigation or expensive licenses, and its business could be adversely affected. |

| ● | Certain of the Company’s products contain third-party open source software components, and failure to comply with the terms of the underlying open source software licenses could restrict its ability to sell its products or expose the Company to other risks. |

| ● | The Company’s intellectual property applications, including patent applications, may not be approved or granted or may take longer than expected to be approved, which may have a material adverse effect on its ability to prevent others from commercially exploiting products similar to its. |

| ● | In addition to patented technology, the Company relies on unpatented proprietary technology, trade secrets, designs, experiences, work flows, data, processes, software and know-how. |

| ● | The markets in which the Company competes are characterized by rapid technological change, and competing product innovations could adversely affect market adoption of its products. |

| ● | The Company’s business depends substantially on the efforts of its executive officers and highly skilled personnel. The Company needs to attract and retain a large number of skilled, specialized and dedicated employees in different jurisdictions in order to grow and manage its business, and if the Company loses the services of existing key employees or fail to achieve its recruitment goals, its operations may be disrupted. |

| ● | Failure to comply with governmental trade controls, including export and import control laws and regulations, sanctions, and related regimes could subject the Company to liability or loss of contracting privileges, limit its ability to compete in certain markets or harm its reputation with the governments. |

| ● | Failures, or perceived failures, to comply with privacy, data protection, and information security requirements in the jurisdictions in which the Company operates may adversely impact its business, and such legal requirements are evolving and may require improvements in, or changes to, its policies and operations. |

| ● | Fluctuations in currency exchange rates may adversely affect the Company’s business and result of operations. |

| ● | The Company’s Business Combination Warrants are accounted for as liabilities and the changes in value of the warrants could have a material effect on its financial results. |

| ● | Interruption or failure of the Company’s information technology and communications systems could impact its ability to effectively provide its products and services. |

| ● | If any of the Company’s third parties’ systems, its customers’ cloud or on-premises environments, or its internal systems are breached or if unauthorized access to customer or third-party data is otherwise obtained, public perception of its business may be harmed, and the Company may lose business and incur losses or liabilities. |

6

| ● | If the Company’s network and products do not interoperate with its customers’ internal networks and infrastructure or with third-party products, websites, or services, its network may become less competitive and its results of operations may be harmed. |

Some of these factors are discussed in more detail in this Annual Report, including under “Item 3. Key Information—Risk Factors,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this Annual Report as anticipated, believed, estimated or expected.

7

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

3.A. [Reserved]

3.B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

3.C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

3.D. RISK FACTORS

You should carefully consider the risks described below, together with all of the other information included in this Annual Report, in evaluating us and our shares. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The trading price and value of our ordinary shares could decline due to any of these risks, and you may lose all or part of your investment. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this Annual Report.

Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations.

Risks Related to Arqit’s Business and Operations

Arqit is an early stage company with a history of losses and will be reliant upon a significant increase in sales and marketing activity in order to become profitable in the future.

Arqit has only just started to generate material revenues through the commercialization of its products. For the years ended September 30, 2021, 2022 and 2023, Arqit generated operating losses of $172.6 million, $63.8 million and $84.4 million, respectively. Arqit intends to continue to invest and to increase investments in sales, marketing and product development, and believes that it will continue to incur operating and net losses until at least the time it is able to fully commercialize its products, but which may occur later than expected or not at all. There can be no assurance that Arqit’s products or its sales strategy will be commercially successful. Arqit’s potential profitability is dependent upon the successful development and commercial introduction and acceptance of its products, which may not occur. Because Arqit will incur the costs and expenses of commercializing its products before it receives any significant revenues with respect thereto, its losses in future periods may be significant. If Arqit is never able to achieve or sustain profitability, its results of operations could differ materially from its expectations and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit’s limited operating history makes it difficult to evaluate its business and future prospects and increases the risk of your investment.

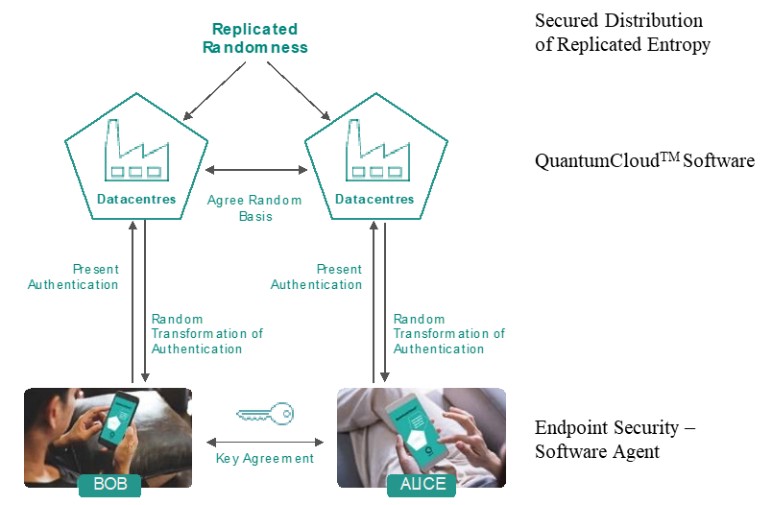

Arqit began operations in 2017, has a limited operating history, and operates in the post-quantum cryptography encryption industry, which is rapidly evolving. As a result, there is limited information that investors can use in evaluating Arqit’s business, strategy, operating plan, results and prospects. Arqit intends to derive most of its revenues from the delivery of its symmetric key agreement product, QuantumCloudTM, which is a newly developed technology. It is difficult to predict future revenues and appropriately budget for expenses, and Arqit has limited insight into trends that may emerge and affect its business. If the assumptions Arqit uses to plan and operate its business are incorrect or change, its results of operations could differ materially from its expectations and Arqit’s business, financial condition and results of operations could be materially adversely affected.

8

The market adoption of Arqit’s product is not fully proven, is evolving and may develop more slowly than or differently from Arqit’s expectations. Its future success depends on the growth and expansion of these markets and its ability to adapt and respond effectively to evolving markets.

The market adoption of Arqit’s product is relatively new, rapidly evolving, and not fully proven. Accordingly, it is difficult to predict customer adoption and renewals and demand for its products and services, the entry of competitive products, the success of existing competitive products, or the future growth rate, expansion, longevity, and the size of the market for its products. The expansion of and its ability to penetrate these new and evolving markets depends on a number of factors, including: the cost, performance, and perceived value associated with its products, and the extent to which its products improve security and are easy to use for its customers. If Arqit experiences security incidents or disruptions in delivery or service, the market for its products may be negatively affected. If its products do not continue to achieve market acceptance, or there is a reduction in demand caused by decreased customer acceptance, technological challenges, weakening economic conditions, privacy, data protection and data security concerns, governmental regulation, competing technologies and products, or decreases in information technology spending or otherwise, the market for its products may not continue to develop or may develop more slowly than Arqit expects, which could adversely affect its business, financial condition, and results of operations.

Arqit’s primary distribution channel is through channel partnerships, and therefore Arqit is dependent upon maintaining and increasing the number of channel partnerships, and developing annual recurring revenues through those channel partnerships, in order to continue to develop its business.

Arqit is in the early stages of commercializing its business, and in December 2022 began transitioning its distribution model from an enterprise license model to distribution through channel partners. There can be no certainty over the pace and scale of revenue growth generated from such relationships, which might take longer than anticipated to generate material revenues. In addition, Arqit is dependent upon maintaining its existing, and increasing the number of, channel partnerships in order to continue to develop its business and annual recurring revenues. If revenues from channel partner relationships fail to develop, take longer than expected to develop, or Arqit fails to maintain existing or increase the number of its channel partnerships, the impact could adversely affect its business, financial condition, and results of operations.

If Arqit fails to sell or otherwise monetize its satellite currently under construction, it may be required to recognize further impairment losses, write off capitalized satellite costs or incur breakage fees under certain of its contracts related to satellite construction obligations.

In December 2022 Arqit updated its technology strategy to eliminate quantum satellites and the associated ground infrastructure from its core QuantumCloudTM product offering. See “Item 4.B. Business Overview - Satellite Infrastructure.” In connection with this update, Arqit is planning to sell or otherwise monetize its quantum satellite currently under construction. In May 2023 Arqit retained an adviser to assist in the process of pursuing the sale of its satellite division amongst other potential transactions. During the fiscal year ended September 30, 2023, Arqit reclassified its satellite assets from “intangible assets” to “assets classified as held for sale”, in connection with which it recognized an impairment loss of $17.6 million. If Arqit fails to sell its satellite currently under construction, it may be required to recognize further impairment losses, write off capitalized satellite costs or incur breakage fees under certain of its contracts related to satellite construction obligations. If such impairment losses or write offs are required or additional expenses are incurred, Arqit’s results of operations could differ materially from its expectations and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit will require additional capital to fund its operations, and if it is unable to obtain such capital, it will be unable to successfully continue to develop its business and commercialize its products.

As of September 30, 2023, Arqit had cash and cash equivalents of approximately $44.5 million. Although Arqit believes it has sufficient funds to fund its operations for the next twelve months as of the filing of this Annual Report on Form 20-F, it will require additional capital in order to successfully continue to develop its business and commercialize its products. There is no assurance that revenues from Arqit’s commercialization of its products will be sufficient to fund its operations in the future, or that additional funds will be available through other sources when required on terms that are acceptable to Arqit, or at all. If Arqit is not able to access the capital required to fund its operations, its business, financial condition and results of operations could be materially adversely affected.

9

Arqit is reliant upon the lease of data center capacity and access to fiber optic infrastructure from third parties in order to commercialize its product.

Arqit leases its data centers and obtains access to fiber optic infrastructure from third parties and will be reliant on the continued operation of these data centers and infrastructure to commercialize its product. While Arqit has electronic access to the components and infrastructure of its cloud platforms that are hosted by third parties, Arqit does not control the operation of these facilities. Consequently, Arqit may be subject to service disruptions as well as failures to provide adequate support for reasons that are outside of its direct control. The data centers or the fiber optic infrastructure Arqit uses to deliver its products may be vulnerable to damage or interruption from a variety of sources, including earthquakes, floods, fires, power loss, system failures, computer viruses, physical or electronic break-ins, human error or interference (including by disgruntled employees, former employees or contractors), and other catastrophic events. Its data centers or the fiber optic infrastructure Arqit uses may also be subject to local administrative actions, changes to legal or permitting requirements and litigation to stop, limit or delay operations. Despite precautions taken at these facilities, such as disaster recovery, business continuity arrangements, and diversity of supply in the Arqit network, the occurrence of a natural disaster or an act of terrorism, a decision to close the facilities without adequate notice or other unanticipated problems at these facilities could result in interruptions or degradations in its services, impede its ability to scale its operations or have other adverse impacts upon its business. In addition, if Arqit does not accurately plan for its infrastructure capacity requirements and Arqit experiences significant strains on its data center capacity, Arqit may experience delays and additional expenses in arranging new data centers, and its customers could experience performance degradation or service outages that may subject it to financial liabilities, result in customer losses and materially harm its business. If Arqit is unable to efficiently and cost-effectively fix such errors at the data centers or fiber optic infrastructure or other problems that may be identified, this could damage its reputation and negatively impact its relationship with its customers. If Arqit is unable to successfully maintain and manage the data centers and the fiber optic infrastructure that Arqit uses, Arqit’s business, financial condition and results of operations could be materially adversely affected.

The complexity of Arqit’s products could result in unforeseen delays or expenses from undetected defects, errors or reliability issues in software, which could reduce the market adoption of its new products, damage its reputation with current or prospective customers and expose it to product liability and other claims and adversely affect its operating costs.

Arqit’s products are highly technical and complex and require high standards to implement and may experience defects, errors or reliability issues at various stages of development and commercial implementation. Arqit may be unable to timely correct problems that have arisen or correct such problems to its customers’ satisfaction. Additionally, undetected errors, defects or security vulnerabilities could result in litigation against Arqit, negative publicity and other consequences. Some errors or defects in its products may only be discovered after they have been tested, commercialized and deployed by customers. If that is the case, Arqit may incur significant additional development costs with respect to its products. These problems may also result in claims, including class actions, against Arqit by its customers or others. Its reputation or brand may be damaged as a result of these problems, customers may be reluctant to buy its products, and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its products or technology. Its efforts to protect and enforce its intellectual property rights and prevent third parties from violating its rights may be costly.

The success of its products and business depend in part on its ability to obtain patents and other intellectual property rights and maintain adequate legal protection for its products. As of the date of this Annual Report, Arqit had 1,966 claims on 41 pending or granted patents in the UK. Arqit relies on a combination of patent, service mark, trademark and trade secret laws, as well as confidentiality procedures and contractual restrictions, to establish and protect its proprietary rights, all of which provide only limited protection.

Arqit cannot assure you that any patents will be issued with respect to its currently pending patent applications or that any trademarks will be registered with respect to its currently pending applications in a manner that provides adequate defensive protection or competitive advantages, if at all, or that any patents issued to Arqit or any trademarks registered by it will not be challenged, invalidated or circumvented. Arqit may file for patents and trademarks in the U.S., U.K. and in certain international jurisdictions, but such protections may not be available in all countries in which it operates or in which Arqit seeks to enforce its intellectual property rights, or may be difficult to enforce in practice. For example, the legal environment relating to intellectual property protection in certain emerging market countries where Arqit may operate in the future is relatively weaker, often making it difficult to create and enforce such rights. Its currently- registered intellectual property and any intellectual property that may be issued or registered, as applicable, in the future with respect to pending or future applications may not provide sufficiently broad protection or may not prove to be enforceable in actions against alleged infringers. Arqit cannot be certain that the steps Arqit has taken will prevent unauthorized use of its technology or the reverse engineering of its technology. Moreover, others may independently develop technologies that are competitive to or infringe its intellectual property.

10

Protecting against the unauthorized use of its intellectual property, products and other proprietary rights is expensive and difficult, particularly internationally. Arqit believes that its intellectual property is foundational in the area of encryption technology and intends to enforce the intellectual property portfolio that Arqit has built. Unauthorized parties may attempt to copy or reverse engineer its technology or certain aspects of its products that it considers proprietary. Litigation may be necessary in the future to enforce or defend its intellectual property rights, to prevent unauthorized parties from copying or reverse engineering its products or technology to determine the validity and scope of the proprietary rights of others or to block the importation of infringing products into the U.S., U.K. or other jurisdictions in which Arqit seeks to protect its intellectual property rights.

Any such litigation, whether initiated by Arqit or a third party, could result in substantial costs and diversion of management resources, either of which could adversely affect its business, operating results and financial condition. Even if Arqit obtains favorable outcomes in litigation, Arqit may not be able to obtain adequate remedies, especially in the context of unauthorized parties copying or reverse engineering its products or technology.

Effective patent, trademark, service mark, copyright and trade secret protection may not be available in every country in which its products are available and competitors based in other countries may sell infringing products in one or more markets. Failure to adequately protect its intellectual property rights could result in its competitors offering similar products, potentially resulting in the loss of some of its competitive advantage, and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Third-party claims that Arqit is infringing intellectual property, whether successful or not, could subject it to costly and time-consuming litigation or expensive licenses, and its business could be adversely affected.

Participants in Arqit’s industry typically protect their technology, especially embedded software, through copyrights and trade secrets in addition to patents. As a result, there is frequent litigation based on allegations of infringement, misappropriation or other violations of intellectual property rights. Arqit may in the future receive inquiries from other intellectual property holders and may become subject to claims that it infringes their intellectual property rights, particularly as Arqit expands its presence in the market, expands to new use cases and faces increasing competition. In addition, parties may claim that the names and branding of Arqit’s products infringe their trademark rights in certain countries or territories. If such a claim were to prevail, Arqit may have to change the names and branding of its products in the affected territories and could incur other costs.

Arqit may in the future need to initiate infringement claims or litigation in order to try to protect its intellectual property rights. In addition to litigation where Arqit is a plaintiff, its defense of intellectual property rights claims brought against it or its customers or suppliers, with or without merit, could be time- consuming, expensive to litigate or settle, could divert management resources and attention and could force Arqit to acquire intellectual property rights and licenses, which may involve substantial royalty or other payments and may not be available on acceptable terms or at all. Further, a party making such a claim, if successful, could secure a judgment that requires Arqit to pay substantial damages or obtain an injunction and Arqit may also lose the opportunity to license its technology to others or to collect royalty payments. An adverse determination could also invalidate or narrow Arqit’s intellectual property rights and adversely affect its ability to offer its products to its customers and may require that Arqit procure or develop substitute products that do not infringe, which could require significant effort and expense. If any of these events were to materialize, Arqit’s business, financial condition and results of operations could be materially adversely affected.

Certain of Arqit’s products contain third-party open source software components, and failure to comply with the terms of the underlying open source software licenses could restrict its ability to sell its products or expose Arqit to other risks.

Arqit’s products contain software modules licensed to it by third-party authors under “open source” licenses. From time to time, there have been claims against companies that distribute or use open source software in their products and services, asserting that open source software infringes the claimants’ IP rights. Arqit could be subject to suits by parties claiming infringement of IP rights in what Arqit believes to be licensed open source software. Use and distribution of open source software may entail greater risks than use of third-party commercial software, as, for example, open source licensors generally do not provide warranties or other contractual protections regarding infringement claims or the quality of the code. Some open source licenses contain requirements that Arqit makes available source code for modifications or derivative works Arqit creates based upon the type of open source software Arqit uses. If Arqit combines its proprietary software with open source software in a certain manner, Arqit could, under certain open source licenses, be required to release the source code of its proprietary software to the public. This would allow its competitors to create similar products with lower development effort and time and ultimately could result in a loss of product sales for Arqit.

Although Arqit monitors its use of open source software to avoid subjecting its products to conditions Arqit does not intend, the terms of many open source licenses have not been interpreted by U.S. courts, and there is a risk that these licenses could be construed in a way that, for example, could impose unanticipated conditions or restrictions on its ability to commercialize its products. In this event, Arqit could be required to seek licenses from third parties to continue offering its products, to make its proprietary code generally available in

11

source code form, to re-engineer its products or to discontinue the sale of its products if re-engineering could not be accomplished on a timely basis, and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit’s intellectual property applications, including patent applications, may not be approved or granted or may take longer than expected to be approved, which may have a material adverse effect on its ability to prevent others from commercially exploiting products similar to its.

Arqit cannot be certain that it is the first inventor of the subject matter to which it has filed a particular patent application or if it is the first party to file such a patent application. The process of securing definitive patent protection can take five or more years. If another party has filed a patent application to the same subject matter as Arqit has, Arqit may not be entitled to some or all of the protection sought by the patent application. Arqit also cannot be certain whether the claims included in a patent application will ultimately be allowed in the applicable issued patent or the timing of any approval or grant of a patent application.

Further, the scope of protection of issued patent claims is often difficult to determine. As a result, Arqit cannot be certain that the patent applications that Arqit files will issue, or that its issued patents will afford protection against competitors with similar technology. In addition, if its competitors may design around its registered or issued intellectual property, Arqit’s business, financial condition and results of operations could be materially adversely affected.

In addition to patented technology, Arqit relies on unpatented proprietary technology, trade secrets, designs, experiences, work flows, data, processes, software and know-how.

Arqit relies on proprietary information (such as trade secrets, designs, experiences, work flows, data, know-how and confidential information) to protect intellectual property that may not be patentable or subject to copyright, trademark, trade dress or service mark protection, or that Arqit believes is best protected by means that do not require public disclosure. Arqit generally seeks to protect this proprietary information by entering into confidentiality agreements, or consulting, services or employment agreements that contain non-disclosure and non-use provisions with its employees, consultants, customers, contractors and third parties. However, Arqit may fail to enter into the necessary agreements, and even if entered into, such agreements may be breached or may otherwise fail to prevent disclosure, third-party infringement or misappropriation of its proprietary information, may be limited as to their term and may not provide adequate remedies in the event of unauthorized disclosure or use of proprietary information. Arqit has limited control over the protection of trade secrets used by its current or future manufacturing counterparties and suppliers and could lose future trade secret protection if any unauthorized disclosure of such information occurs. In addition, its proprietary information may otherwise become known or be independently developed by its competitors or other third parties. To the extent that Arqit’s employees, consultants, customers, contractors, advisors and other third parties use intellectual property owned by others in their work for it, disputes may arise as to the rights in related or resulting know-how and inventions. Costly and time- consuming litigation could be necessary to enforce and determine the scope of its proprietary rights, and failure to obtain or maintain protection for its proprietary information could adversely affect its competitive business position. Furthermore, laws regarding trade secret rights in certain markets where Arqit operate may afford little or no protection to its trade secrets.

Arqit also relies on physical and electronic security measures to protect its proprietary information, but cannot provide assurance that these security measures will not be breached or provide adequate protection for its property. There is a risk that third parties may obtain and improperly utilize its proprietary information to its competitive disadvantage. Arqit may not be able to detect or prevent the unauthorized use of such information or take appropriate and timely steps to enforce its intellectual property rights, and Arqit’s business, financial condition and results of operations could be materially adversely affected.

The markets in which Arqit competes are characterized by rapid technological change, and competing product innovations could adversely affect market adoption of its products.

While Arqit has invested substantial resources in technological development, and believes that its product is a unique innovation, continuing technological changes in quantum technology and changes in the markets for its products could adversely affect adoption of its products, either generally or for particular applications. Arqit’s future success will depend upon its ability to develop and introduce a variety of new capabilities and innovations to its product offerings, as well as to introduce a variety of new product offerings, to address the changing needs of the markets in which Arqit offers its products. Delays in delivering new products that meet customer requirements could damage its relationships with customers and lead them to seek alternative sources of supply. Delays in introducing products and innovations, the failure to choose correctly among technical alternatives or the failure to offer innovative products or configurations at competitive prices may cause existing and potential customers to purchase its competitors’ products or turn to alternative technology.

If Arqit is unable to devote adequate resources to develop products or cannot otherwise successfully develop products or system configurations that meet customer requirements on a timely basis or that remain competitive with technological alternatives, its products

12

could lose market share, its revenue could decline, and Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit’s business depends substantially on the efforts of its executive officers and highly skilled personnel. Arqit needs to attract and retain a large number of skilled, specialized and dedicated employees in different jurisdictions in order to grow and manage its business, and if Arqit loses the services of existing key employees or fail to achieve its recruitment goals, its operations may be disrupted.

Competition for highly-skilled personnel is often intense and Arqit may incur significant costs to attract and retain highly-skilled personnel. Arqit may not be successful in attracting, integrating, or retaining qualified personnel to fulfill its current or future needs. As its business grows, Arqit will need to recruit a large number of skilled employees in different jurisdictions in which it operates and expects to expand into in the future. Experienced and highly skilled employees are in high demand, competition for these employees can be intense and Arqit’s ability to hire, attract and retain them depends on its ability to provide competitive compensation. Arqit will also need to expend significant time and expense to train the employees that it hires and it may struggle to retain employees, and its competitors may actively seek to hire skilled personnel away from it. If Arqit fails to attract new personnel or to retain and motivate its current personnel, its business and future growth prospects could be adversely affected.

Failure to comply with governmental trade controls, including export and import control laws and regulations, sanctions, and related regimes could subject Arqit to liability or loss of contracting privileges, limit its ability to compete in certain markets or harm its reputation with the governments.

Arqit’s products are subject to export controls in the U.S., U.K. and other jurisdictions, and Arqit incorporates encryption technology into its product offerings. Some of the underlying technology in Arqit’s products may be exported outside of these countries only with the required export authorizations, which may require a license, a license exception, or other appropriate government authorizations, including the filing of an encryption classification request or self-classification report.

Furthermore, its activities are subject to the economic sanctions, laws and regulations of the U.S. and other jurisdictions. Such controls prohibit the shipment or transfer of certain products and services without the required export authorizations or export to countries, governments, and persons targeted by applicable sanctions. Arqit takes precautions to prevent its offerings from being exported in violation of these laws, including: (i) seeking to proactively classify its platforms and obtain authorizations for the export and/or import of its platforms where appropriate, (ii) implementing certain technical controls and screening practices to reduce the risk of violations, and (iii) requiring compliance with U.S. export control and sanctions obligations in customer and vendor contracts. However, Arqit cannot guarantee the precautions it takes will prevent violations of export control and sanctions laws.

As discussed above, if Arqit misclassifies a product or service, export or provides access to a product or service in violation of applicable restrictions, or otherwise fails to comply with export regulations, Arqit may be denied export privileges or subjected to significant per violation fines or other penalties, and its platforms may be denied entry into other countries. Any decreased use of its platforms or limitation on its ability to export or sell its platforms would likely adversely affect its business, results of operations and financial condition. Violations of sanctions or export control laws can result in fines or penalties, including both civil and criminal penalties.

Arqit also notes that if it or its business partners or counterparties, including licensors and licensees, prime contractors, subcontractors, sublicensors, vendors, customers, or contractors, fail to obtain appropriate import, export, or re-export licenses or permits, notwithstanding regulatory requirements or contractual commitments to do so, or if Arqit fails to secure such contractual commitments where necessary, Arqit may also face reputational harm as well as other negative consequences, including government investigations and penalties.

Negative consequences for violations or apparent violations of trade control requirements may include the absolute loss of the right to sell Arqit’s platforms or services to the government of the U.S., or to other public bodies, or a reduction in its ability to compete for such sales opportunities. Further, complying with export control and sanctions regulations for a particular sale may be time-consuming and may result in the delay or loss of sales opportunities.

Other countries in addition to the U.S. and U.K. also regulate the import and export of certain encryption and other technology, including import and export licensing requirements, and have enacted laws that could limit Arqit’s ability to distribute its products or could limit its end-customers’ ability to implement its products in those countries. Changes in Arqit’s products or future changes in export and import regulations may create delays in the introduction of its platform in international markets, prevent its end- customers with international operations from deploying its platform globally or, in some cases, prevent the export or import of its products to certain countries, governments, or persons altogether. From time to time, various governmental agencies have proposed additional regulation of encryption technology. Any change in export or import regulations, economic sanctions or related legislation, increased export and import controls, or change in the countries, governments, persons, or technologies targeted by such regulations, could result in decreased

13

use of Arqit’s platform by, or in its decreased ability to export or sell its products to, existing or potential end-customers with international operations. If there is any limitation on its ability to export or sell its products, Arqit’s business, financial condition and results of operations could be materially adversely affected.

Failures, or perceived failures, to comply with privacy, data protection, and information security requirements in the jurisdictions in which Arqit operates may adversely impact its business, and such legal requirements are evolving and may require improvements in, or changes to, its policies and operations.

Arqit’s current and potential future operations and sales are subject to laws and regulations addressing privacy and the collection, use, storage, disclosure, transfer and protection of a variety of types of data. The primary data privacy laws applicable to Arqit include U.K. General Data Protection Regulation and the U.K. Data Protection Act of 2018. These regimes may, among other things, impose data security requirements, disclosure requirements, and restrictions on data collection, uses, and sharing that may impact its operations and the development of its business. Arqit’s products collect, store and process certain information and its products may evolve to collect additional information. Therefore, the full impact of these privacy regimes on its business is rapidly evolving across jurisdictions and remains uncertain at this time.

Arqit may also be affected by cyber-attacks and other means of gaining unauthorized access to its products, systems, and data. For instance, cyber criminals or insiders may target it or third parties with which Arqit has business relationships to obtain data, or in a manner that disrupts its operations or compromises its products or the systems into which its products are integrated.

Arqit continually assesses the evolving privacy and data security regimes and implements measures that Arqit believes are appropriate in response. Since these data security regimes are evolving, uncertain and complex, especially for a global business like Arqit’s, it may need to update or enhance its compliance measures as its products, markets and customer demands further develop, and these updates or enhancements may require implementation costs. In addition, Arqit may not be able to monitor and react to all developments in a timely manner and the compliance measures that Arqit adopts may prove ineffective.

Any failure, or perceived failure, to comply with current and future regulatory or customer-driven privacy, data protection, and information security requirements, or to prevent or mitigate security breaches, cyber-attacks, or improper access to, use of, or disclosure of data, or any security issues or cyber-attacks affecting Arqit, could result in significant liability, costs (including the costs of mitigation and recovery), and a material loss of revenue resulting from the adverse impact on Arqit’s reputation and brand, loss of proprietary information and data, disruption to its business and relationships, and diminished ability to retain or attract customers and business partners. Such events may result in governmental enforcement actions and prosecutions, private litigation, fines and penalties or adverse publicity, and could cause customers and business partners to lose trust in Arqit, and its business, financial condition and results of operations could be materially adversely affected.

Fluctuations in currency exchange rates may adversely affect Arqit’s business and result of operations.

Arqit’s functional currency is GBP and its reporting currency is U.S. dollars. Accordingly, fluctuations in the value of GBP relative to the U.S. dollar could affect its results of operations due to translational remeasurements. As its international operations expand, an increasing portion of its revenue and operating expenses will be denominated in non-GBP currencies. Accordingly, Arqit’s revenue and operating expenses will become increasingly subject to fluctuations due to changes in foreign currency exchange rates. If Arqit is not able to successfully hedge against the risks associated with currency fluctuations, Arqit’s business, financial condition and results of operations could be materially adversely affected.

Arqit’s Business Combination Warrants are accounted for as liabilities and the changes in value of the warrants could have a material effect on its financial results.

In accordance with IFRS 9 – Financial Instruments and IAS 32 – Financial Instruments: Presentation, Arqit has determined that its Business Combination Warrants should be measured at fair value on its statement of financial position, with any changes in fair value to be reported each period in earnings on its statement of comprehensive income. As a result of the recurring fair value measurement, Arqit’s financial statements may fluctuate on an interim basis, based on factors which are outside of its control. Due to the recurring fair value measurement, Arqit expects that it will recognize non-cash gains or losses on its Business Combination Warrants each reporting period and that the amount of such gains or losses could be material.

Interruption or failure of Arqit’s information technology and communications systems could impact its ability to effectively provide its products and services.

The availability and effectiveness of Arqit’s services depend on the continued operation of information technology and communications systems. Its systems will be vulnerable to damage or interruption from, among others, physical theft, fire, terrorist attacks, natural

14

disasters, power loss, war, telecommunications failures, viruses, denial or degradation of service attacks, ransomware, social engineering schemes, insider theft or misuse or other attempts to harm its systems. Arqit utilizes reputable third-party service providers or vendors for all of its IT and communications systems, and these providers could also be vulnerable to harms similar to those that could damage its systems, including sabotage and intentional acts of vandalism causing potential disruptions. Some of its systems will not be fully redundant, and its disaster recovery planning cannot account for all eventualities. Any problems with its third-party cloud hosting providers could result in lengthy interruptions in its business. In addition, Arqit’s services and functionality are highly technical and complex technology which may contain errors or vulnerabilities that could result in interruptions in its business or the failure of its systems.

If any of Arqit’s third parties’ systems, its customers’ cloud or on-premises environments, or its internal systems are breached or if unauthorized access to customer or third-party data is otherwise obtained, public perception of its business may be harmed, and Arqit may lose business and incur losses or liabilities.

Arqit’s success depends in part on its ability to provide effective data security protection in connection with its platforms and services, and Arqit relies on information technology networks and systems to securely store, transmit, index, and otherwise process electronic information. Because its platforms and services are used by its customers to encrypt large data sets that often contain proprietary, confidential, and/or sensitive information (including in some instances personal or identifying information and personal health information), its software is perceived as an attractive target for attacks by computer hackers or others seeking unauthorized access, and its software faces threats of unintended exposure, exfiltration, alteration, deletion, or loss of data. Additionally, because many of Arqit’s customers use its platforms to store, transmit, and otherwise process proprietary, confidential, or sensitive information, and complete mission critical tasks, they have a lower risk tolerance for security vulnerabilities in its platforms and services than for vulnerabilities in other, less critical, software products and services.

Arqit, and the third-party vendors upon which Arqit relies, have experienced, and may in the future experience, cybersecurity threats, including threats or attempts to disrupt its information technology infrastructure and unauthorized attempts to gain access to sensitive or confidential information. Its and its third-party vendors’ technology systems may be damaged or compromised by malicious events, such as cyberattacks (including computer viruses, malicious and destructive code, phishing attacks, and denial of service attacks), physical or electronic security breaches, natural disasters, fire, power loss, telecommunications failures, personnel misconduct, and human error. Such attacks or security breaches may be perpetrated by internal bad actors, such as employees or contractors, or by third parties (including traditional computer hackers, persons involved with organized crime, or foreign state or foreign state-supported actors).

Cybersecurity threats can employ a wide variety of methods and techniques, which may include the use of social engineering techniques, are constantly evolving, and have become increasingly complex and sophisticated; all of which increase the difficulty of detecting and successfully defending against them.

Furthermore, because the techniques used to obtain unauthorized access or sabotage systems change frequently and generally are not identified until after they are launched against a target, Arqit and its third-party vendors may be unable to anticipate these techniques or implement adequate preventative measures. Although prior cyberattacks directed at Arqit have not had a material impact on its financial results, and Arqit is continuing to bolster its threat detection and mitigation processes and procedures, Arqit cannot guarantee that future cyberattacks, if successful, will not have a material impact on its business or financial results. While Arqit has security measures in place to protect its information and its customers’ information and to prevent data loss and other security breaches, there can be no assurance that Arqit will be able to anticipate or prevent security breaches or unauthorized access of its information technology systems or the information technology systems of the third-party vendors upon which Arqit relies. Despite its implementation of network security measures and internal information security policies, data stored on personnel computer systems is also vulnerable to similar security breaches, unauthorized tampering or human error.

Many governments have enacted laws requiring companies to provide notice of data security incidents involving certain types of data, including personal data. In addition, most of Arqit’s customers contractually require Arqit to notify them of data security breaches. If an actual or perceived breach of security measures, unauthorized access to its system or the systems of the third-party vendors that Arqit rely upon, or any other cybersecurity threat occurs, Arqit may face direct or indirect liability, costs, or damages, contract termination, its reputation in the industry and with current and potential customers may be compromised, its ability to attract new customers could be negatively affected, and its business, financial condition, and results of operations could be materially and adversely affected.

Further, unauthorized access to Arqit’s or its third-party vendors’ information technology systems or data or other security breaches could result in the loss of information; significant remediation costs; litigation, disputes, regulatory action, or investigations that could result in damages, material fines, and penalties; indemnity obligations; interruptions in the operation of its business, including its ability to provide new product features, new platforms, or services to its customers; damage to its operation technology networks and information technology systems; and other liabilities. Moreover, its remediation efforts may not be successful. Any or all of these issues,

15

or the perception that any of them have occurred, could negatively affect Arqit’s ability to attract new customers, cause existing customers to terminate or not renew their agreements, hinder Arqit’s ability to obtain and maintain required or desirable cybersecurity certifications, and result in reputational damage, any of which could materially adversely affect its results of operations, financial condition, and future prospects. There can be no assurance that any limitations of liability provisions in Arqit’s license arrangements with customers or in its agreements with vendors, partners, or others would be enforceable, applicable, or adequate or would otherwise protect it from any such liabilities or damages with respect to any particular claim.

Arqit maintains cybersecurity insurance and other types of insurance, subject to applicable deductibles and policy limits, but its insurance may not be sufficient to cover all costs associated with a potential data security incident. Arqit also cannot be sure that its existing general liability insurance coverage and coverage for cyber liability or errors or omissions will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims or that the insurer will not deny coverage as to any future claim. The successful assertion of one or more large claims against Arqit that exceed available insurance coverage, or the occurrence of changes in its insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could result in its business, financial condition and results of operations being materially adversely affected.

If Arqit’s network and products do not interoperate with its customers’ internal networks and infrastructure or with third-party products, websites, or services, its network may become less competitive and its results of operations may be harmed.

Arqit’s network and products must interoperate with its customers’ existing internal networks and infrastructure. These complex internal systems are developed, delivered, and maintained by the customer and a myriad of vendors and service providers. As a result, the components of its customers’ infrastructure have different specifications, rapidly evolve, utilize multiple protocol standards, include multiple versions and generations of products, and may be highly customized. Arqit must be able to interoperate and provide products to customers with highly complex and customized internal networks, which requires careful planning and execution between its customers, its customer support teams and, in some cases, its channel partners.

Further, when new or updated elements of its customers’ infrastructure or new industry standards or protocols are introduced, Arqit may have to update or enhance its network to allow it to continue to provide its products to customers.

Arqit may not deliver or maintain interoperability quickly or cost-effectively, or at all. These efforts require capital investment and engineering resources. If Arqit fails to maintain compatibility of its network and products with its customers’ internal networks and infrastructures, its customers may not be able to fully utilize its network and products, and Arqit may, among other consequences, lose or fail to increase its market share and number of customers and experience reduced demand for its products, and its business, financial condition and results of operations could be materially adversely affected.

Risks Related to Ownership of Ordinary Shares and Warrants

It may be difficult to enforce judgments obtained against Arqit or its directors and officers in U.S. courts, to effect service of process on it or its directors or officers, and to recover in civil proceedings in the U.K. or elsewhere for U.S. securities law violations.

The majority of Arqit’s directors and executive officers reside outside of the U.S., and most of its assets and most of the assets of these persons are located outside of the U.S. Therefore, a judgment obtained against Arqit, or any of these persons, including a judgment based on the civil liability provisions of the U.S. federal securities laws, may not be collectible in the U.S. and may not be enforced by courts in other jurisdictions. It may also be difficult for its shareholders to effect service of process on these persons in the U.S. or to assert U.S. securities law claims in original actions instituted in the U.K. or elsewhere. U.K. courts may refuse to hear a claim based on an alleged violation of U.S. securities laws reasoning that U.K. is not the most appropriate forum in which to bring such a claim. In addition, even if a U.K. court agrees to hear a claim, it may determine that U.K. law, instead of U.S. law, is applicable to the claim. As a result of potential difficulties associated with enforcing a judgment against Arqit, its shareholders may not be able to collect any damages awarded by either a U.S. or foreign court.

Because Arqit is incorporated under the laws of the Cayman Islands, you may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited.

Arqit is an exempted company incorporated under the laws of the Cayman Islands. As a result, it may be difficult for shareholders to effect service of process within the United States upon the directors or executive officers of Arqit, or enforce judgments obtained in the United States courts against the directors or officers of Arqit.

The corporate affairs of Arqit are governed by Arqit’s amended and restated memorandum and articles of association, the Cayman Companies Act and the common law of the Cayman Islands. The rights of shareholders to take action against the directors, actions by

16

minority shareholders and the fiduciary responsibilities of the directors of Arqit under Cayman Islands law are to a large extent governed by the common law of the Cayman Islands. The common law of the Cayman Islands is derived in part from comparatively limited judicial precedent in the Cayman Islands as well as from English common law, the decisions of whose courts are of persuasive authority, but are not binding on a court in the Cayman Islands. The rights of Arqit shareholders and the fiduciary responsibilities of Arqit directors under Cayman

Islands law are different from what they would be under statutes or judicial precedent in some jurisdictions in the United States. In particular, the Cayman Islands has a less prescriptive body of securities laws as compared to the United States, and certain states, such as Delaware, may have more fully developed and judicially interpreted bodies of corporate law. In addition, shareholders of Cayman Islands companies may not have standing to initiate a shareholders’ derivative action in a federal court of the United States.

Shareholders of Cayman Islands exempted companies like Arqit have no general rights under Cayman Islands law to inspect corporate records or to obtain copies of the register of members of these companies. Arqit directors have discretion under our articles of association to determine whether or not, and under what conditions, our corporate records may be inspected by our shareholders, but are not obliged to make them available to our shareholders. This may make it more difficult for you to obtain the information needed to establish any facts necessary for a shareholder motion or to solicit proxies from other shareholders in connection with a proxy contest.

The courts of the Cayman Islands are unlikely (i) to recognize or enforce against Arqit judgments of courts of the United States predicated upon the civil liability provisions of the federal securities laws of the United States or any state, and (ii) in original actions brought in the Cayman Islands, to impose liabilities against Arqit predicated upon the civil liability provisions of the federal securities laws of the United States or any state, so far as the liabilities imposed by those provisions are penal in nature. In those circumstances, although there is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, the courts of the Cayman Islands will recognize and enforce a foreign money judgment of a foreign court of competent jurisdiction without retrial on the merits based on the principle that a judgment of a competent foreign court imposes upon the judgment debtor an obligation to pay the sum for which judgment has been given provided certain conditions are met. For a foreign judgment to be enforced in the Cayman Islands, such judgment must be final and conclusive and for a liquidated sum, and must not be in respect of taxes or a fine or penalty, inconsistent with a Cayman Islands judgment in respect of the same matter, impeachable on the grounds of fraud or obtained in a manner, or be of a kind the enforcement of which is, contrary to natural justice or the public policy of the Cayman Islands (awards of punitive or multiple damages may well be held to be contrary to public policy). A Cayman Islands court may stay enforcement proceedings if concurrent proceedings are being brought elsewhere.

As a result of all of the above, shareholders of Arqit may have more difficulty in protecting their interests in the face of actions taken by our management, members of our board or our controlling shareholders than they would as public shareholders of a United States company.

The grant and future exercise of registration rights and exercise of outstanding warrants may adversely affect the market price of Arqit ordinary shares.

Pursuant to the Registration Rights Agreement described elsewhere in this Annual Report, certain shareholders can each demand that Arqit register their registrable securities under certain circumstances and will each have piggyback registration rights for these securities in connection with certain registrations of securities that Arqit undertakes. Arqit will bear the cost of registering these securities.